Legislative priorities

PSBA is the voice of school boards and public education in the halls of the Capitol. We are actively involved in a wide range of legislative issues and work to leverage change on the issues of greatest importance to local school officials.

Our advocacy work includes drafting bills and amendments, participating in meetings, and providing analyses and comments on key proposals. In addition to fostering support for the issues most relevant to local school officials, PSBA strives to protect public education by working to block harmful legislation.

Our key issues include:

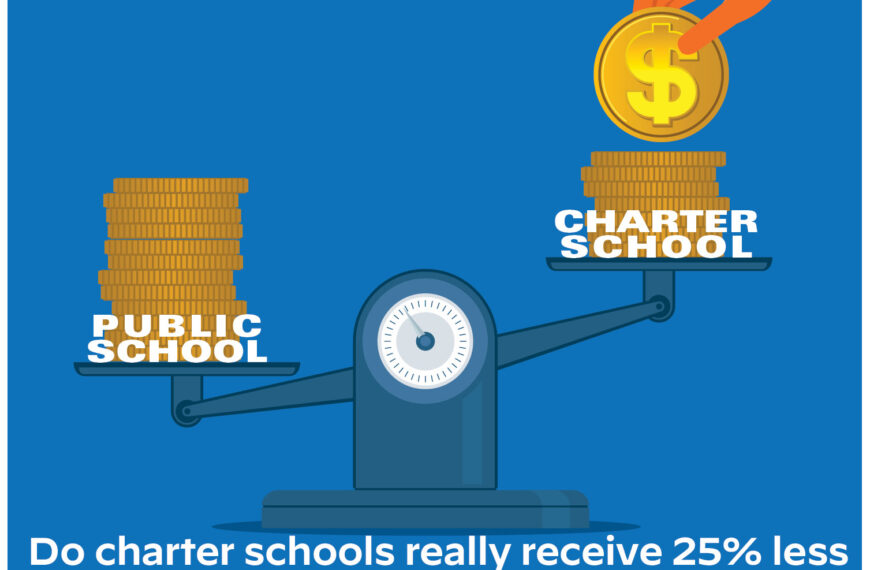

PSBA believes that the state must enact comprehensive and meaningful charter school reforms that reduce the financial burden on school districts and require the same high standards of academic performance and accountability.

Adopted by the PSBA Delegate Assembly as a legislative priority issue for the 2023-24 session of the General Assembly.

The state’s Charter School Law (CSL) dates back to 1997, and outside of adding provisions which allowed for the creation of cyber charter schools in 2002, has seen very little change since its enactment 25+ years ago.

Due to the significant need for charter school reform, PSBA created a Charter School Task Force made up of school board directors, superintendents and school solicitors as part of a multiyear effort to examine the state’s current charter school law, along with previous efforts to update the law. In addition, the task force studied data and conducted panel discussions with advocates and organizations representing different perspectives in order to develop a series of specific, balanced recommendations for meaningful charter school reforms.

PSBA also created the Keystone Center for Charter Change at PSBA (Center). The mission of the Center is to build support for the development and enactment of legislation that would provide regulatory and funding changes to the CSL through active advocacy, timely research, increased awareness, as well as education on issues related to charter school reform. The Center’s website is an excellent resource for facts, figures and explanations that demonstrate the need for reform.

PSBA supports significant, continued state and federal financial investment for school districts.

Adopted by the PSBA Delegate Assembly as a legislative priority issue for the 2023-24 session of the General Assembly.

Although state government and local school districts are partners in funding public schools, this partnership has been less than equal. Only about 37% of the costs of public education is covered by the state. Only eight other states receive a lower proportion of public education funding from state revenues than Pennsylvania. Local school districts are forced to make up the difference, mostly through property taxes. Asking districts to continually generate greater resources at the local level only serves to expand the inequities of the current system and widens the gap between poor and affluent school districts.

Since the Commonwealth Court issued its landmark ruling in 2023 finding Pennsylvania’s system of public education unconstitutional, the state is in a unique position to increase its share of education funding to benefit the state’s 1.7 million public school students and to better enable all school districts to provide a world-class education.

PSBA stands ready to assist the General Assembly to accomplish the monumental task of reshaping the public education system to meet the diverse needs of school districts and students across the state.

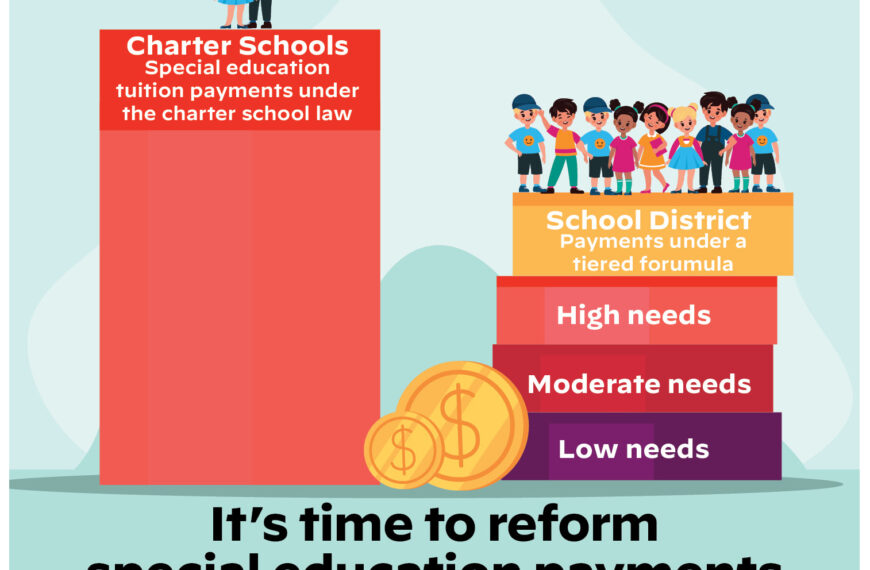

Special Education

School districts are required by law to provide students with disabilities with a free appropriate public education, or “FAPE”. The provision of FAPE requires schools to provide the programs, services and supports that a student with a disability needs in order to receive an education. These added rights and protections come at an additional cost. But as costs have increased, state and federal special education funding has failed to keep pace. In the 2011-12 school year, 32% of all special education expenditures were covered by state and federal funding. By 2021-22 that percentage had fallen to just 24%.

To meet the needs of the state’s 313,000 public school students with disabilities and to better enable all school districts to provide world-class special education programs and services, the state and federal governments should increase their share of special education funding.

PSBA supports the prioritization of the mental health and safety needs of students.

Adopted by the PSBA Delegate Assembly as a legislative priority issue for the 2023-24 session of the General Assembly.

School districts must provide safe and supportive school environments for their students. Students’ mental and emotional health impacts their ability to learn, the safety and security of our schools, the classroom environment for all students, and the work environment for teachers and staff.

One of the most pressing needs facing school leaders has been addressing the mental health needs of their students. With student social-emotional issues impacting learning being a top instructional challenge, many school districts are expanding their programs and services to address this growing need. Public schools need flexibility to be able to provide an array of varied mental health services that are built on a strong foundation of consistent school programs and access to well-trained professionals.

Schools need adequate and continued state resources in order to supplement current mental health programs and services and to help with continued funding of these programs and services as one-time federal pandemic and state mental health grant dollars are exhausted. These critical funds allow districts to provide additional mental health staff and services that best meet the needs of their students and communities.

PSBA also supports common sense efforts to help our schools in safety matters while emphasizing that there is no one-size-fits-all solution to providing safe school environments. School districts are vastly different throughout Pennsylvania in their needs; therefore, the best approaches to school safety often must be determined at the local school district level. The state must provide schools with continued and long-term funding, assistance and flexible options that best meet the needs of their communities to provide safe and secure school environment. Grants should also be available to assist schools in meeting safety and security preparedness initiatives, including funds for physical security enhancements, personnel, training and other needs.

PSBA opposes efforts to provide direct financial aid to students who would use those funds to enroll in non-public schools or efforts that would divert state or federal funding away from school districts in order to fund such programs.

Adopted by the PSBA Delegate Assembly as a legislative priority issue for the 2023-24 session of the General Assembly.

Voucher programs redirect taxpayer dollars from public schools to pay for private educational uses. Repackaged under different names, private school vouchers all function to undermine public education and publicly subsidize private education. Legislative proposals to create voucher plans have been introduced in states across the country, including Pennsylvania.

Private school vouchers can be disguised to look like:

- Education Savings Account Vouchers (ESA): ESA vouchers are public funds deposited into a personal account that can be used to pay for a student’s private school tuition or other education expenses, such as tutoring, online coursework, transportation or homeschooling. These vouchers can be specialized to only affect special education students or perhaps only the children of armed service members.

- Scholarship programs: Scholarship programs aim to provide students in one or more classifications with public funds which the student’s family could then use to pay for private school tuition, tutoring, or other educational programs or services.

- Traditional private school vouchers: Traditional vouchers pay for all or part of a student’s private school tuition with direct payments from a public treasury. States may impose student eligibility requirements, limits on voucher amounts and/or conditions on private schools receiving voucher students.

The problem with vouchers

- While vouchers are described as an option to help certain groups of students, studies of voucher programs across the country have found that students who participate in private school voucher programs fare worse academically than students educated in public schools.

- Voucher plans siphon millions of dollars from school districts, many that are already under-resourced, to benefit private schools.

- While public schools have strong accountability measures for public meetings, transparency, governance, academic achievement, testing/reporting and financial responsibilities, private and other non-public schools have almost complete autonomy over how they operate.

- Vouchers do nothing to improve the education of all students. Creating a separate education system does nothing to address inadequacies or issues with existing public school systems. Subsidizing private schools doesn’t help the 90% of children who attend public schools.

- Students attending a private or other non-public school and their families are not entitled to the same rights and protections as students and families in public schools such as special education for students with disabilities and student discipline.

School districts and other local governments are required to provide public notice of meetings, bidding requirements for certain purchases and contracts, legal notices and official advertisements. The only legally permissible method of providing that public notice dates back to a 1976 law which requires that the notice be provided in printed newspapers. This mandate was created long before the Internet changed the ways that people receive information.

PSBA fully supports the need to keep the taxpayers and communities informed of district events and operations. However, as the frequency of printed newspaper publishing dwindles (and in some areas disappears) school leaders are required to plan their business around newspaper publication dates. As more people shift away from printed newspapers as their major source of information, school leaders are also confronted with the challenge of efficiently and effectively notifying their constituents of upcoming school business.

PSBA is advocating for solutions which would provide school districts and other local governments with a flexible menu of print and electronic options for advertising legal notices. One-size-fits-all solutions are not effective and rarely work in a state as large and diverse as Pennsylvania. Offering districts flexibility with more options for advertising is one way we can ensure that school officials are able to interact with greater numbers of the community in a more timely and cost-effective manner. Allowing public notices to be posted electronically will not only boost visibility due to increased access to and usage of the internet, but public notices would also be searchable and available to a broader community base.

School districts have an obligation to provide facilities that are constructed and maintained to meet the educational and safety needs of their students and staff. In turn, the state has a responsibility to help districts pay for needed construction and renovation projects. However, school districts have faced a two-fold obstacle in meeting their obligation — inadequate or nonexistent state funding, and overly complicated state approval process for school construction projects, known as PlanCon.

Through PSBA’s advocacy efforts, Act 70 of 2019 was enacted to modernize and simplify the PlanCon process. It also creates a project building maintenance and repair grant program to be used for smaller maintenance and modernization projects as well as health and safety upgrades, emergencies and other approved projects.

Unfortunately, the new PlanCon program remains unused and unfunded. A moratorium that began in 2016 and continues today on accepting school projects for reimbursement has left districts and taxpayers left to carry the full financial burden.

Many schools across the state are struggling with a variety of facility maintenance, renovation and construction needs. However, the lack of state reimbursement for school construction has forced many school districts to postpone needed renovations or to cut educational programs to free up resources to address critical construction or maintenance needs.

For these reasons, it’s time to restart and provide sustainable state funding for the new the PlanCon program. This effort must be a priority – our students and families are counting on us.

While Pennsylvania’s Right-to-Know Law (RTKL) guarantees citizens with access to the public records of state and local government agencies, including school districts, some important reforms are needed to address unintended consequences of the law that have a negative impact on such agencies and their taxpayers.

Commercial requests

One of the unintended consequences of the law has been the ability of individuals and companies to obtain information through the RTKL that they intend to use for financial gain, for example, a request for addresses and information that the requester will use to solicit new customers or a request for information that the requester will then re-sell as part of a service or product.

School districts must spend staff time and resources to comply with commercial requests. Many of these types of requests are vague, overbroad or voluminous and can take hours to locate a wide array of records, redact information in the records, or require the involvement of a school district’s attorney to evaluate the request.

Districts cannot recoup any of the costs associated with complying with these requests because the current fee structure in the law does not allow for charging any fees beyond duplication and mailing costs. As a result, taxpayers are being forced to foot the bill for assisting in the marketing and profit-making efforts of private businesses. While school districts have no desire to prohibit commercial requests, a solution must be found to provide a better balance.

Vexatious requests

The intent of the RTKL was to ensure that residents had access to information about their government. However, another unintended consequence has been the ability to use the law with malicious intent to intimidate, harass or punish an agency, which results in bogging down the agency and wasting taxpayer resources. This was never anticipated by the General Assembly when the original statute was passed. While cases of vexatious requesters are not the norm, agencies need the ability to seek relief from those requesters who seek to use the law as a weapon.

PSBA promotes exceptional public education.

During the 2021 – 22 legislative session, PSBA successfully worked with our members to support public education in the commonwealth.

Resources

PSBA’s internal subject matter experts regularly produce reports about crucial issues impacting public education in Pennsylvania. These reports are intended to clearly and concisely communicate the challenges that school leaders face to key stakeholders, including legislators and community members.

State of Education report

The annual State of Education report is intended to serve as a barometer of not only the key indicators of public school performance, such as standardized test scores and school finances, but also the timely challenges that public schools are facing and how they are coping with them.

The goal of the report is to provide a high-level overview of the key indicators of the state of public education in the commonwealth, which will facilitate key education policy discussions among legislators and school leaders.

Data used in the State of Education report comes from surveys of school leaders and a compilation and analysis of publicly available data from sources such as the Pennsylvania Department of Education (PDE) and National Center for Education Statistics.

Closer Look publications

The Closer Look series provides in-depth information and research on key K-12 public education and advocacy topics. They are intended to provide the public, parents, school leaders and legislators with insights on timely issues.